onity group

Price per share at posting: $40.98 Date of posting: Sept 28, 2025

Business

Onity Group (Ticker: ONIT) is a financial services company focused on originating and servicing forward and reverse mortgage loans, primarily in the United States. In 2024, the company generated $1.1 billion in revenue and $33.9 million in net income. Onity operates in a competitive and consolidating mortgage servicing industry.

The Simple Value Story

Onity’s history has been turbulent. Following the Great Recession, its founder and then-CEO pursued an overly aggressive foreclosure strategy that backfired, saddling the company with lawsuits, regulatory penalties, and heavy debt. In 2018, Onity acquired PFF and appointed PFF’s CEO, Glen Messina, to lead the combined firm. Since then, Messina has streamlined operations, refinanced debt, and returned the company to profitability and stability.

Despite this turnaround, the market continues to undervalue Onity.

Onity’s current tangible book value is $482 million, compared with a market capitalization of $330 million[1]. Moreover, the company is poised to reverse approximately $170 million of deferred tax valuation adjustments—likely after Q4—lifting tangible book value to roughly $652 million. If the market simply re-rated Onity to book value, the stock could nearly double from $41 to about $82.

Over the past four quarters, Onity has generated adjusted net income averaging $20 million per quarter—about $80 million annually. At the current share price, the trailing P/E ratio is just 4.1. If the market applied even a conservative multiple of 10x earnings, the implied share price would be around $100, a potential 143% gain.

Relative to peers, Onity looks especially cheap. The industry leader, Mr. Cooper, trades at approximately 2.6x book value and has a P/E ratio of 25 (with EPS of $8.74 over the last 12 months). By contrast, Onity trades at just 0.7x book and 4.1x adjusted earnings.

Discussion

Onity makes money in several ways. The most important is as a mortgage servicer. As a mortgage servicer, it collects monthly payments, manages escrow accounts, handles delinquencies, and processes foreclosures. For these functions, Onity earns recurring fees tied to the outstanding principal balance of the mortgages it services. Today, it manages approximately $300 billion in mortgages, making it one of the major players in the U.S. servicing market. Importantly, servicers like Onity do not assume credit risk on these mortgages; the owner of the loan bears that risk.

Mortgage servicing rights (MSRs) are valuable assets. Onity acquires them through its own originations, through purchases from large mortgage holders, and via competitive bidding. At the end of Q4 2024, Onity owned servicing rights to $302 billion of underlying mortgages, carried at a fair value of $2.47 billion. This value is marked to market each quarter, primarily reflecting interest rate movements. When rates fall, refinancing activity rises, shortening the life of the mortgage and reducing MSR value.

Onity also originates new mortgages — about $85 billion in 2024. These loans are typically sold quickly after origination, with Onity retaining the MSRs. At Q2, 2025, for example, the company held just $1.2 billion in loans for sale. Because the loans are sold rapidly, Onity faces minimal interest rate or default risk on its originated portfolio.

The company also maintains a meaningful presence in reverse mortgages, originating, servicing, and holding approximately $11 billion. Here too, Onity earns steady fees across the lifecycle of the loan. While repayment timing is uncertain — it depends on property sales or borrower death — the company is contractually entitled to all fees and is guaranteed reimbursement by the federal government if loan balances exceed property value.

The principal risk to Onity is interest rate volatility. Falling rates drive refinancing that erodes MSR value. To mitigate this, Onity both hedges with swaps and derivatives and benefits from a natural offset: when refinancing surges, its origination business expands, generating fresh fee income and replenishing MSRs. Hedging does not fully eliminate exposure, but it helps stabilize results

Ultimately, Onity’s model is straightforward: originate mortgages, sell them while retaining MSRs, efficiently service both forward and reverse mortgages, and use scale to operate more profitably than peers. The business is fee-driven, capital-light, and built on recurring revenues.

Over the remaining sections I go through some of the details of Onity’s operations and financial statements.

Reverse Mortgages and Loans Held for Investment

Onity engages in reverse mortgages. Typically, reverse mortgages are taken out by senior citizens that own their houses outright, but don’t have cash flow. Onity provides the cash, and the house serves as the collateral. Every month that the reverse mortgage exists, more of the house principal is transferred to Onity. The mortgage owed to Onity is repaid when the house is sold, either at the choice of the owner, or upon their death. Onity is only owed the outstanding cash plus interest – there is no windfall gains possible. If the owner outlives the value of their house, the Home Equity Conversion Mortgage program, operated through the Federal Housing Administration, guarantees the payments. There is no risk of default risk or loss of funds to Onity.

At Q2, 2025, Onity had $10.47B loans held for investment assets on its balance sheet. These are the loans associated with the reverse mortgages; these assets are secure.

On the liabilities side, Onity had $10.253B of Home Equity Conversion Mortgaged-Backed securities as part of the reverse loans program. So, while Onity has $10.253B of loans, there is no real liability risk issues since they are more than matched by the guaranteed loans held for investment.

The only uncertainty with the reverse mortgage program is the timing of the cash flows. Onity is repaid when the underlying housing asset is sold. This timing is largely out of Onity’s control.

Mezzanine Equity

At Q4, 2024, Onity issued $49.9m of Series B, preferred shares. These shares were used to raise approximately $50m in cash. These funds are recorded as mezzanine equity. Mezzanine equity has features of both debt and equity. These liabilities have the right to receive 7.875% interest payable in quarterly dividends for five years, after which the interest rate grows by 2.5% per year, to a maximum of 15%. On or after September 15, 2028, Onity has the right to redeem the entirety of this equity for $50m, plus any outstanding interest. I treat this as debt.

Debt Refinance in Q4, 2024

In Q4, 2024, Onity refinanced or repaid $685m of outstanding debt. The early repayment and refinancing of this debt resulted in a net one-time accounting loss of $49.9m. The upsides of this refinancing were lower debt and lower average interest rates.

However, one effect of the $49.9m write down is that Q4 earnings were -$28.1m. Without the $49.9m write down, Onity would have shown a profit of roughly $15m in Q4.

Steady State Earnings

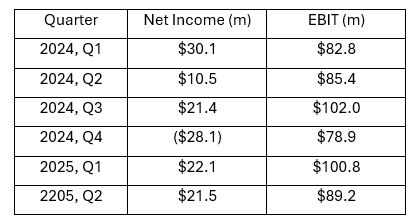

Here are Onity’s net income and EBIT for the last six quarters:

As explained previously, the $28.1m loss in Q4, 2024 was due to refinancing debt early. Other than this loss, it appears that Onity has stabilized its earnings.

The Q4 debt refinancing and accounting charge may be masking Onity’s earnings. Over the past four quarters Onity’s reported net income is $36.5m (PE=10.4). However, if the accounting charge is ignored, the net income over the trailing four quarters would have been approximately $81m (PE=4.1).

Onity is on track to earn net income of at least $80m in 2025.

Shares Outstanding

At the end of Q4, 2024, Onity had 7.87m shares outstanding. At the end of Q2, 2025, it had 8.055m shares outstanding (diluted shares were 8.53m). These additional shares were a function of managerial stock compensation.

Outstanding Stock Warrants

At Q4, 2025, Onity had 261,248 warrants outstanding to Oaktree with a strike price of $24.31, expiring on May 3, 2025. On Feb 3, 2025, Oaktree exercised the options. Rather than issue new shares, Onity elected to settle in cash for $3.5m.

At Q4, 2025, Onity had outstanding 1,184,768 warrants outstanding to Oaktree with a strike price of $26.82 and an expiration date of March 4, 2027. Onity has the option to issue shares or repurchase for cash when Oaktree decides to exercise the options.

Stock Repurchases

On November 20, 2022, Onity repurchased 1,750,557 shares at an average price of $28.53, and a total price of $50m. This, and the recent settlement of the outstanding warrants, are the only shares Onity has repurchased in the last 5 years.

Management

In my opinion management has done a very good job over the last 7 years. The CEO, Glen Messina, joined Onity when Onity purchased PFF Corporation in 2018. Since that time Messina has been improving operations and cleaning up the balance sheet. At this point these efforts are largely complete. The refinancing steps taken in Q4, 2024 have effectively eliminated the balance sheet risk to the company, and reduced interest rates.

Current management has done an excellent job of running operations over the last 7 years.

I am pleased with the way management has treated shares. It completed a major stock repurchase when the stock price was at its lowest point. Rather than issue more shares when Oaktree exercised its options in Q1, management simply bought out the shares.

Valuation

Here I’ll simply redo the calculations from above but adjust for the number of warrants.

If the 1,184,768 warrants were exercised, the total shares outstanding would increase to 9,239,768. The warrants would sell for $26.82 each, so they will bring in $31.8M of cash.

This cash would bring total book value to $513.7m. Adding in the $170m revaluation of prior operating losses would bring total book value to $638.7M.

With 9.2m shares outstanding, the market value would be $378.6m.

If market value increased to book value it would result in a 68% increase in Onity’s stock price to $69 per share.

If Onity is valued at 10 times earnings of $80m it would have a market value of $800m. This would increase Onity’s stock price by 111% to $86 per share

Conclusion

Using the valuation methods of tangible book value, price earnings ratios, and comparison to competitors, Onity is significantly undervalued.

While Onity is in a competitive industry, it is operating well and hedging its risks.

Management is competent and is trying to increase shareholder value.

There are two potential catalysts. First, there is the potential for $170m of valuation adjustments for net operating losses, during Q4. Second, continued stable net income of $20m per quarter could be a catalyst.

Based on book value and P/E ratio, continued stable earnings of $20m per quarter could increase the stock price to between $69 and $86 per share.

[1] This is not exactly right. Onity’s total equity is $482m. Total assets are $16,531m. Of this are $2,636m of intangible assets that are the book value of the MSR that Onity has purchased on the open market, and that are adjusted quarterly on a mark-to-market basis. This value adjusts as market conditions adjust, much like the value of a bond adjusts. There is a direct link between the value of these MSR’s and the expected future payments from the MSR’s. While these assets are contracts, they are contracts linked directly to expected future cash flows – again, much like bonds. I include these assets at tangible book value even though they don’t meet the strict definition for tangible assets.