gulf marine services

Price per share at posting: $0.15 Date of posting: Oct 20, 2025

Business

Gulf Marine Services (ticker: GMS.L) operates 13 self-elevating, self-propelled service vessels. Twelve of the vessels are used to service oil drilling and pumping platforms located in the Arabian Gulf; one vessel is used to service and install wind turbines in the North Sea.

The Simple Value Story

As of October 17, 2025, Gulf Marine Services had a tangible book value of $406 million versus a market capitalization of $172 million - a tangible book-to-market ratio of 2.36. If the shares were to trade at tangible book value, the upside would be about 136%.

Based on adjusted net income of $28 million, the stock trades at roughly 6.1 times earnings. A rerating to a P/E of 10 would imply a 63% increase in price.

Discussion

GMS went public in 2014, and things turned down almost immediately. From 2015 to 2020 the average day rates for a vessel dropped from $59k to $25k, and utilization dropped from 98% to 70%. In 2018 net debt was $400m and net debt to EBITDA was 7. The company was in danger of going bankrupt.

Seafox International bought enough shares on the open market to gain effective control of the company, and then replaced the prior CEO and management team with the current team. The current team has done a very effective job at turning the company around. Profits are positive, and debt has been brought under control.

Debt

Net debt stood at $179 million at mid-2025, or 1.73× EBITDA. Falling below 2× is a key milestone: it reduces the interest rate to EIBOR + 2.25% and allows the company to resume equity distributions.

Day Rates and Utilization

The day rates and utilization have continued to increase steadily since 2018, as demonstrated in the following figure.

Revenues and Operating Income

With the increases in day rates and utilization, and the decrease in debt and interest payments, revenues and operating income have both increased. Annual revenues have been running between $160-170m per year. That has continued into the first half of 2025, and it is management’s guide for the rest of 2025.

Adjusted profits before taxation in 2023 and 2024, respectively were $12.1m, and $34.8m.

Adjusted profits before taxation for the first half of 2025 were $16.8m – approximately the same run rate as 2024.

Net Income and Taxes

In 2023, net income was $42 million (including $32 million of impairment reversals) and taxes were $2.9 million.

In 2024, net income was $38.3 million (including $8.3 million of reversals) with $4.9 million in taxes.

Management guided to $28 million of net income in 2025.

However, the first-half results were distorted by a one-time $9.1 million tax charge dating back to 2017, pushing the effective tax rate to ~75%. Excluding this item, underlying H1 net income would have been $14 million, consistent with guidance.

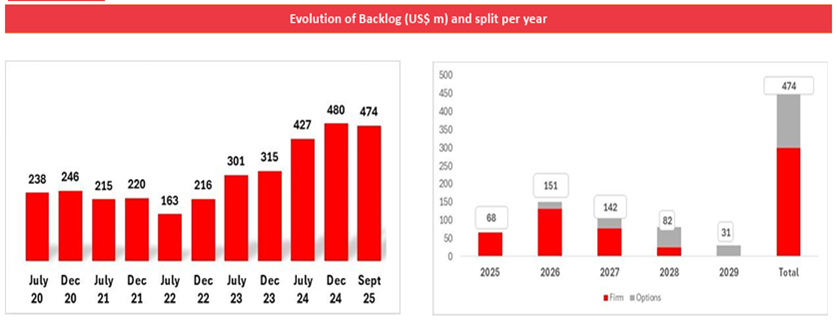

Current Backlog

GMS books contracts up to 6 years in advance. Backlog has steadily increased since 2020, as demonstrated by the following figure. Backlog currently sits at $474m; approximately 2.7 years at current revenue rates.

Again, this extensive backlog makes projecting continued net income in the range of $28m reasonable.

Shares Outstanding

Shares outstanding have expanded sharply in recent years, primarily due to the exercise of warrants issued as part of the Seafox recapitalization and debt restructuring. As of mid-2025, all related warrants had either expired or been exercised.

Shares outstanding currently rest at 1.152B.

Part of the explanation for the weakness in share prices over the last year is Seafox’s divestment from GMS. At its peak Seafox owned over 30% of all outstanding shares. For liquidity reasons, beginning in late 2024 Seafox began distributing its shares in GMS to its own shareholders. These shareholders promptly sold the shares of GMS on the open market, dragging down the price of GMS. By the end of 2024 Seafox’s ownership in GMS had declined to approximately 8%, and based on the latest filings Seafox now owns just under 5% of outstanding shares.

Equity Return to Shareholders

Since the current management took over in 2020 there have been no dividends or share repurchases.

Management guided that they first wanted to reduce the debt burden to below 2 net debt/EBITDA. They indicate that they are interested in returning 20-30% of net income to shareholders in the form of some combination of dividends and share repurchases once the debt ratio gets below 1.5. Management anticipates that this will happen during H1, 2026.

Plans for Future Equity

Management projects that net income will be in the range of $28m per year, and that they will return approximately 25% of that ($7m) per year in dividends and share repurchases.

They indicate that they are interested in growing the business by increasing the number of vessels at the rate of one per year for the next five years. They have a goal of doubling the EBITDA from approximately $100m per year now to $200m per year in five years this way.

Management

Management has executed the turnaround impressively—cutting costs, boosting utilization, refinancing debt on better terms, and building a solid backlog

My main concern is the capital allocation and expansion plan.

First, based on both book value and estimated earnings, with shares trading roughly 50% below intrinsic value, every dollar allocated to repurchases could yield an immediate 100% return. Management should use any excess capital in the most valuable way available. To me this would be repurchasing shares at current prices.

Second, expanding the fleet in a softening market risks depressing day rates and recreating the oversupply problems that nearly sank the company in 2018. Competitors are already expanding, and these vessels have a 30+ year lifetime. Any excess supply will exacerbate pricing and profits well into the future.

Valuation

Based on tangible book value there is potentially a 136% upside from current share price to $0.34.

Based on $28m in annual net income and a P/E of 10, the market value would be $280. This would result in a 63% increase in the share price to $0.24.

As a comparison consider Tidewater Inc. Tidewater provides similar services to GMS in the energy sector. Tidewater trades at 2.14 × book and 12.6× earnings, which highlights how deeply discounted GMS remains.

Risks

Oil price risk: Lower oil prices reduce drilling activity and service demand, pressuring both day rates and utilization. Over the past year, oil fell from $73 to $61 per barrel, and the EIA forecasts an oversupply of roughly 4 million bpd into 2026.

Oversupply risk: New self-elevating vessels are entering the market, and GMS itself plans to add one vessel per year for five years. This expansion could weigh on rates and margins.

Conclusion

GMS is in an industry that isn’t going away anytime soon.

GMS is operating very well. Management has done a very good job of reducing costs, reducing debt, increasing revenues, increasing profitability, and increasing backlog.

By the value measures of tangible book value and P/E ratio, GMS is undervalued by between 63% and 136%.

Management has indicated that they will begin to return equity to shareholders during H1, 2026, including potential share buybacks.

However, there are two important risks, both of which are already occurring. First, oil prices have dropped. Second, the supply of servicing vessels is increasing.