Deutsche bank

The Business

DB is the largest bank in Germany. It provides retail and private banking, corporate and transaction banking, lending, asset and wealth management products and services, as well as focused investment banking to private individuals, small and medium-sized companies, corporations, governments, and institutional investors. It has strong European roots and a global network of operations.

The Simple Value Story

DB had a decade long route from 2009 through 2019. During that period they suffered from the Great Recession, Covid, terrible governance, and multiple fines and elevated legal expenses arising from multiple illegal and duplicitous operations. The number of shares outstanding quadrupled, and the share price dropped from a high of $145 to a low of $6.

Since 2019 operations have turned a corner with the hiring of Christian Sewing as CEO. He actively moved the organization’s priorities away from revenue generation and towards operations where DB could be competitive. He began layoffs that would ultimately result in 18,000 people being laid off.

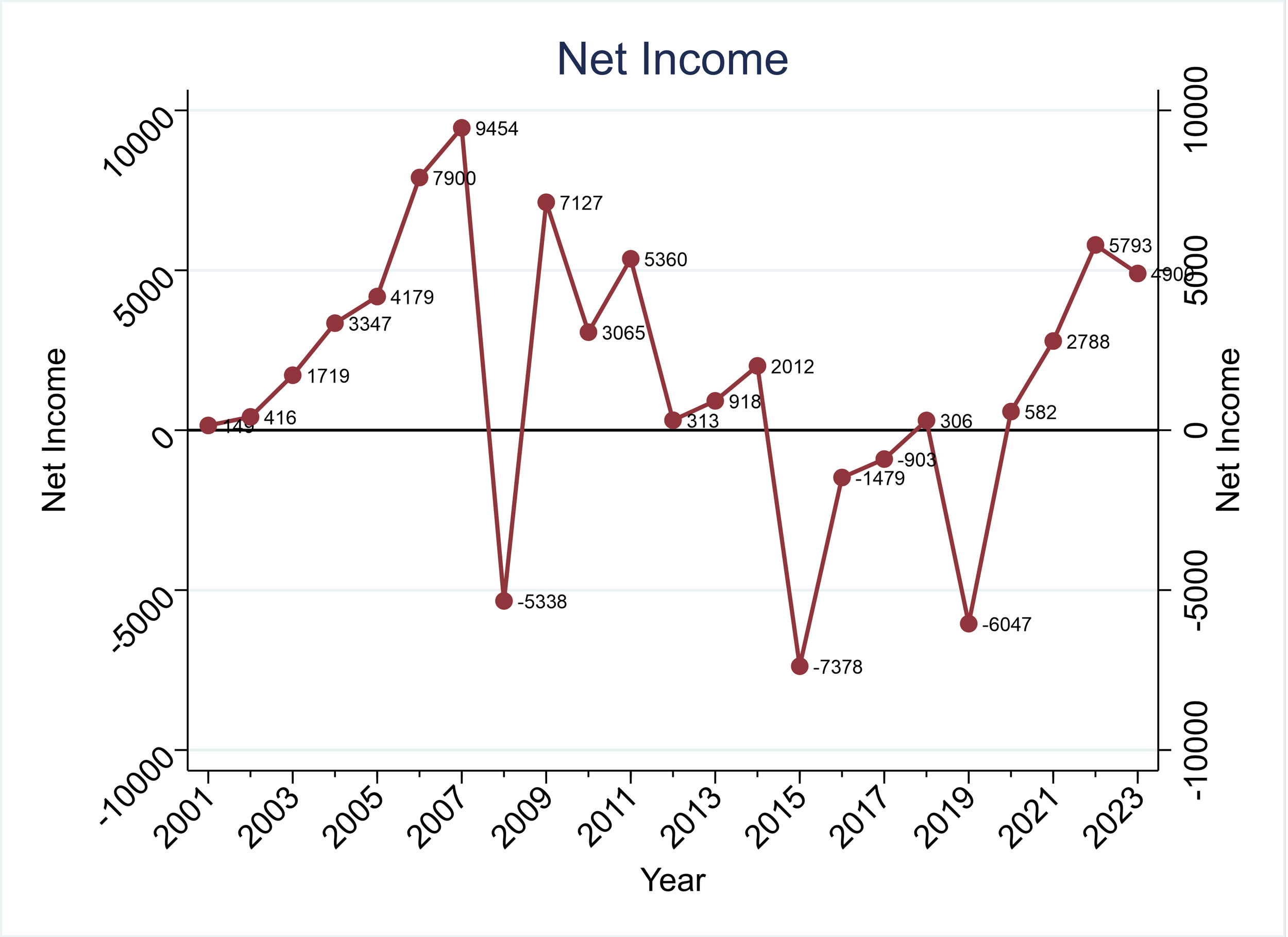

In 2021 DB achieved its first positive annual net income since 2014.

By any conventional metric DB is currently a very inexpensive stock:

DB’s tangible book value is $65B while its market cap it approximately $27B (book-to-market of 2.4).

DB’s current P/E ratio is 5.4. In 2022 and 2023 it had net income of $5.0B and $4.9B, respectively (pretax income grew from $5.5 to $5.7B, but its taxes increased in 2023).

DB projects that it will grow revenues by between 5.5-6.5% over the next two years, with a projected 2025 revenue of €32B, while cutting annual expenses by €1.7B (through announced layoffs of 3500 back-office personnel). These two measures will increase earnings.

DB has restarted dividends. In 2022 and 2023 it paid annual dividends of €0.20 and €0.30. It is set to pay €0.45 in 2024, and projects dividends in 2025 and 2026 of €0.68 and €1.00.

DB has also begun to repurchase shares outstanding. It repurchased €450m in 2023 and it has begun a €675m share repurchase program in Q1, 2024. DB has indicated that it intends to expand share repurchases in the future, as permitted by future earnings.

DB has a Piotroski score of 8.[1]

Discussion

DB was formed in 1870 and is currently Germany’s largest bank. It has expanded its operations to over 58 countries with a strong presence in Europe, the United States and Asia.

After growing quickly and profitably for many decades, DB encountered many negative issues between the Great Recession and 2019. In particular, it paid many billions of dollars in fines and legal expenses related to money laundering in Russia, manipulating the LIBOR market, conducting operations to avoid sanctions in Libya, Sudan, Syria, and Iran. It has been accused of manipulating foreign exchange markets and money laundering in its Russian operations.[2]

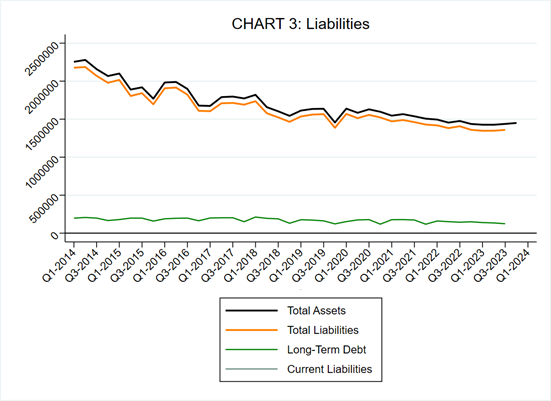

DB began the process of cleaning up operations with the hiring of John Cryan in 2015. However, visible progress only appeared in 2019 with the hiring of Christian Sewing as CEO. Over the last 4 years DB has materially reorganized and downsized its equity trading, its FICC trading, shrunk its balance sheet, and eliminated approximately 18,000 positions.

By most of the standard metrics to evaluate banks DB is performing well. At year-end 2023 DB’s Common Equity Tier 1 capital ratio was 13.7%. Its leverage ratio was 4.5%. Its return on tangible equity was 7.4%. Its net income was $4.9B. DB projects continuing increase revenues and another €1.7B decrease in annual expenses.

The one potential point of concern is DB’s provision for loan losses. In 2022 the provision was €351m and in 2023 it was €1505. The main reason for the increase is that Germany is undergoing a recession, so delinquent loans are increasing. While the current rate of delinquent loans are manageable, the trend is a point of concern.

Valuation

The simplest way to value DB is based on its tangible book value. Using tangible book value is a routine way of valuing banks. Banks are very competitive, so excess returns are unlikely. At present DB’s tangible Book-to-Market is 2.35. At a Book-to-Market of 1, DB’s share price would increase from $13.50 to $31.5.

The following figure presents DB’s tangible Book-to-Market over the last 22 years. As the stock price rose over the last 2 years its tangible Book-to-Market has started to move towards 1. Moreover, prior to the lost decade for DB beginning in 2009, it was typical for DB to have a tangible Book-to-Market of 1 or less.

A review of the tangible Book-to-Market ratios for 20 of the largest U.S. and European banks demonstrates that targeting a Book-to-Market of 1 is reasonable. For these 20 banks the average tangible Book-to-Market is 0.85 (weighted by market cap), with a range of 0.44 to 3.17. DB is the second highest at 2.35.

Another was to estimate DB’s value based on future earnings. DB’s current and projected P/E ratio is approximately 5. The average P/E ratio for the same 20 largest banks in Europe and the U.S. is 9.7. Valuing DB as 10 times earnings would approximately double its current share price to $27.

Catalysts

There are few possible catalysts:

Repurchasing €675 in outstanding shares

Continuing to increase the dividend

Hitting the projected revenue increases, expense reductions, and the resulting income increases

Demonstrating over time that DB is no longer operating in the shadows of the international banking system.

Risks

The obvious risks for banks in general are elevated delinquent loans during recessions. This is exactly what precipitated the Great Recession and DB’s own troubles beginning in 2009.

DB had €479B in loans at the end of 2023 (roughly stable over the last year). These loans make up roughly one third of all assets on the balance sheet. The loans are for German mortgages, international mortgages, corporate lending, corporate real estate, asset backed securities, commercial lending, and so on. Any significant deterioration in the value of these loans will have a direct effect on both DB’s tangible book value and its annual income.

There is no way that I can evaluate the current value of these loans accurately.

However, perhaps a few indirect assessments are possible. First, Germany is in the midst of a mild recession. Germany is by far DB’s largest exposure to mortgage default. So far there is no indication that there is anything out of the unusual occurring with DB’s mortgage book. Second, DB is highly regulated. So far DB is meeting all its mandated metrics. Third, there was a contained crisis in banking in spring 2023 when Silicon Valley Bank and Credit Swisse had to be taken over (by First Citizens Bank and UBS, respectively). Despite these tremors, there was no operating problems at DB.

A second major risk is that perhaps DB is still operating in the under-belly of the international financial network. I have no way of assessing this probability. The only way we’ll know is if more impropriety is brought to light, or not. However, it has been over six years since the last major violations were exposed. Given the close scrutiny that DB has undergone over the last 15 years, if there were any more skeletons it is very likely that they would have been exposed by now.

Conclusions

By all objective criteria, DB is approximately 50% undervalued. All metrics are pointing in the right direction. The company is increasing its dividend, increasing share repurchases, increasing revenues, and decreasing expenses. If these trends continue it is likely that the stock will move higher.

These clear benefits must be balanced against the severity of future recessions and the possibility that DB will have any nefarious operations exposed.

However, all investments are subject to risks. In this case the obvious and large benefits dominate the uncertain risks. I recommend this stock. There is a good chance that it will double over the next two years.

[1] Piotroski tested whether using 9 measures of business operations could predict future elevated stock price returns in share prices for companies with high book-to-market. He found that companies with scores of 8 or 9 beat the market substantially on average over the next year.

[2]DB was Donald Trump’s only financier for almost 20 years.