close Brothers Group

Price per share at posting: £4.29 Date of posting: Oct 28, 2025

Business

Close Brothers Group (CBG.L) is a UK-based merchant bank focused primarily on serving small and medium-sized enterprises. Its strategy centers on building leading positions in specialized lending markets, reinvesting where it holds a competitive edge, and developing deep operational expertise within each niche. Through strong client relationships and disciplined underwriting CBG has been a profitable enterprise for many years.

The bank operates a range of niche lending businesses, including asset finance, aviation and marine lending, motor vehicle finance, beverage finance, and vehicle hire. This diversified specialization allows it to maintain high margins and resilient performance through credit cycles. The company notes that it borrows long and lends short to preserve liquidity and limit refinancing risk.

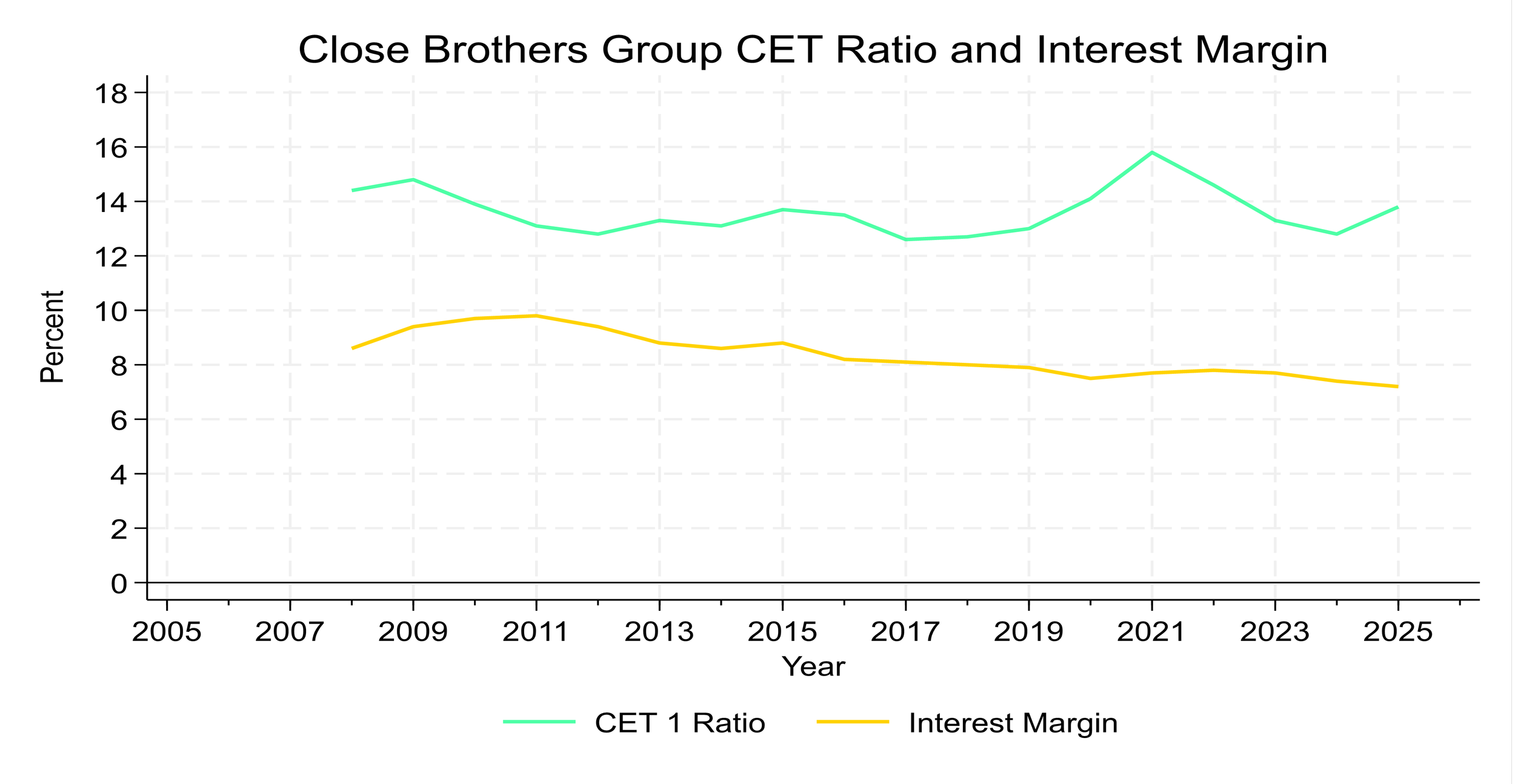

For fiscal year 2025 (ended July 31, 2025), CBG reported operating income of £659 million, adjusted operating profit of £144 million, a Common Equity Tier 1 (CET1) capital ratio of 13.8%, a net interest margin of 7.2%, and a loan book totaling £9.5 billion.

The Simple Value Story

CBG is a conservative and, by most measures, well-managed merchant bank.

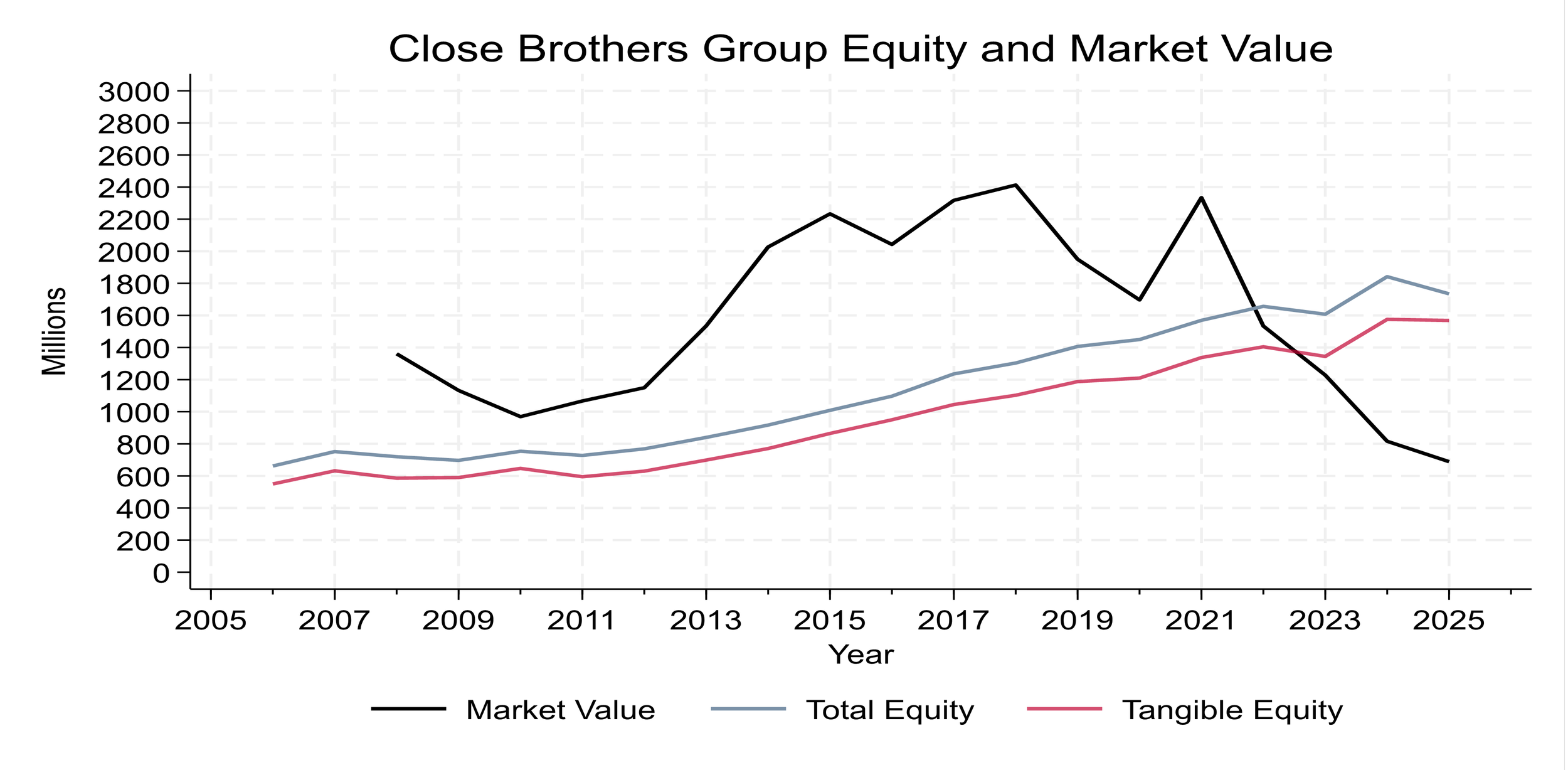

As of July 31, 2025, the company reported total equity of £1.74 billion and tangible equity of £1.57 billion. With a current market capitalization of £654 million, the stock trades at a tangible book-to-market ratio of 2.40.

If the shares were to re-rate to trade at tangible book value (a ratio of 1.0), the implied upside is roughly 140%. Between 2005 and 2025, CBG’s shares have traded at an average tangible book-to-market ratio of 0.75, underscoring how deeply discounted the stock is by this metric.

The following chart presents CBG market value, total equity, and tangible equity. Note that historically the market value is well above tangible equity.

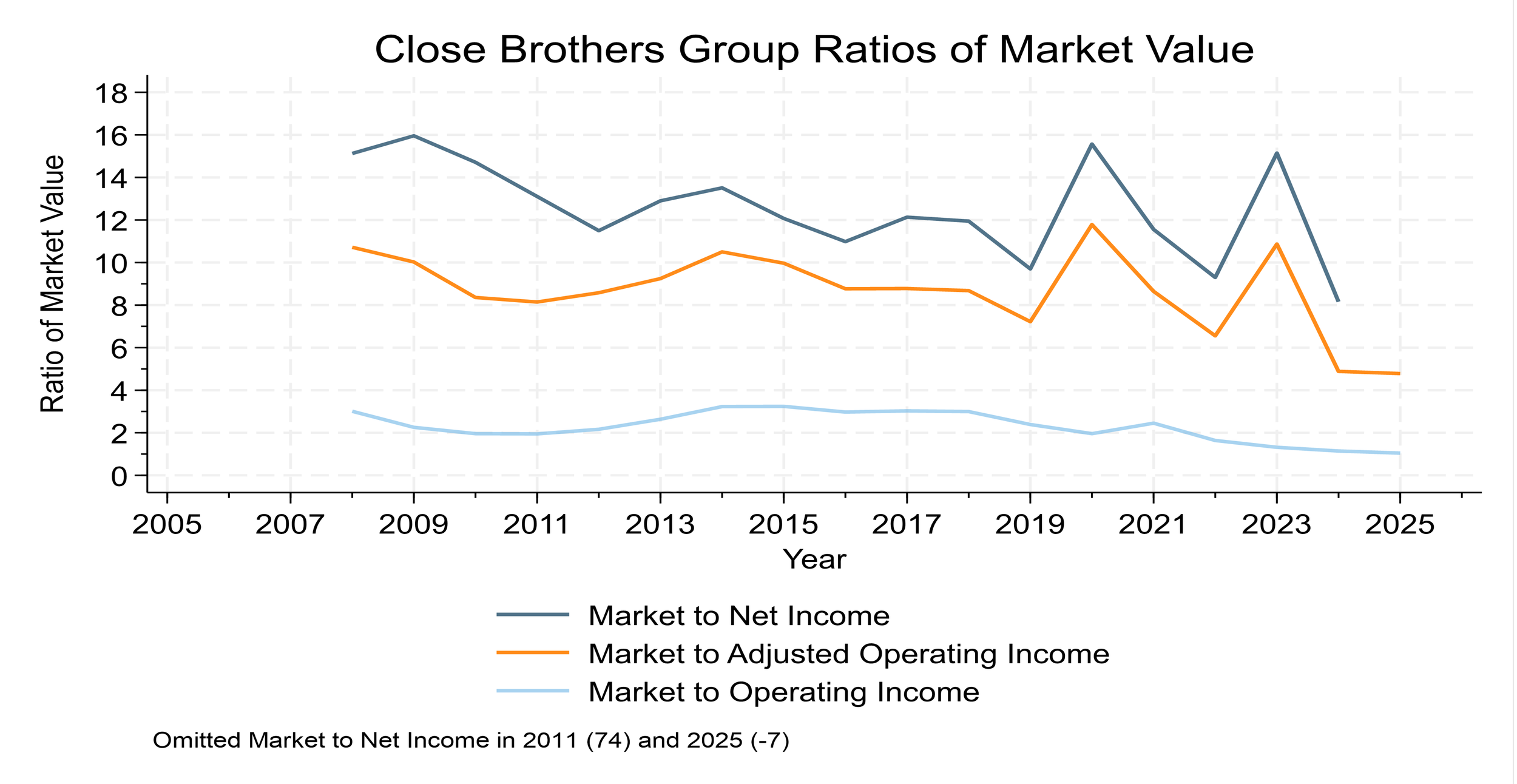

Earnings multiples tell a similar story. Since 2008, CBG’s market capitalization has averaged 8.7 times its adjusted operating income. For fiscal 2025, that multiple stands at just 4.8 times, implying an 82% potential upside if the valuation returns to its long-term average.

The accompanying chart shows CBG’s annual market value relative to net income (P/E), operating income, and adjusted operating income. All three valuation ratios remain well below their historical norms, reinforcing the conclusion that Close Brothers shares are currently priced at historically depressed levels.

The Hopcraft Case and the FCA Investigation

The sharp drop in CBG’s share price stems from a UK Financial Conduct Authority (FCA) investigation into historic motor finance practices.

In January 2024, the FCA launched a probe into commission arrangements between banks and car dealerships. Under the system in place, dealers earned higher commissions from lenders when they arranged loans at higher interest rates, creating an incentive to charge borrowers more. Although the practice was banned in 2021, several banks, including Close Brothers, continued these arrangements.

Anticipating potential fines, CBG booked a £165 million provision during fiscal 2025, driving the net loss for the year. FCA guidance suggested penalties could range from 5% to 20% of revenues tied to the offending loans. While the law was enacted in 2021, the FCA indicated that it was considering enforcing the law retroactively to 2007.

Three test cases eventually reached the UK Supreme Court: Hopcraft (against CBG) and Wrench and Johnson (against FirstRand Bank). On August 1, 2025, the Court dismissed Hopcraft and Wrench, ruling that car dealers acting as credit brokers did not owe fiduciary duties to borrowers. However, in Johnson, it found that the commission structure created an unfair relationship, ordering compensation to the borrower equal to the dealer’s commission plus interest.

Following the decision, the FCA introduced an industry-wide redress scheme outlining which commission models would qualify, how unfairness would be determined, and how compensation would be calculated. Based on the proposed framework, CBG is going to take an additional £135 million provision, bringing total anticipated losses to £300 million.

CBG has pushed back, arguing that the FCA’s redress model overstates customer harm and conflicts with the Supreme Court’s legal findings. The firm also objects to the FCA’s plan to apply the program retroactively to loans originated as far back as 2007, fourteen years before the 2021 rule change.

While the Supreme Court’s dismissal of Hopcraft was initially viewed as positive for CBG, the FCA’s broad and retrospective interpretation of the Johnson ruling has reignited investor concern. The combination of higher expected provisions and ongoing regulatory uncertainty has been the key driver behind the stock’s recent decline.

Discussion

While some uncertainty remains regarding the final redress costs, most of the ambiguity regarding CBG’s legal exposure has now been resolved. Even if the full £300 million that CBG has provisioned for the FCA redress scheme is ultimately paid, the company still appears significantly undervalued.

Future performance will depend primarily on two factors: the stability of CBG’s equity base and the bank’s ability to sustain its historical level of profitability. On both fronts, the fundamentals appear sound.

1. Capital Position

After accounting for the additional £135 million provision for potential redress payments, CBG’s tangible equity will stand near £1.43 billion versus a current market capitalization of £654 million. This represents a substantial capital cushion and a valuation multiple that remains quite low by historical standards.

2. Profitability and Margins

Both the bank’s net interest margin and Common Equity Tier 1 (CET1) capital ratio remain stable, though interest margins have trended modestly lower over time. Importantly, there has been no material deterioration in revenues, credit quality, or lending operations throughout the investigation period. Here is a chart of CET1 ratio and interest margin.

3. Loan Book Stability

CBG’s loan book remains robust at £9.5 billion, only slightly below the £9.8 billion recorded in 2024. The decline reflects a deliberate strategy to bolster liquidity and maintain a strong CET1 ratio amid regulatory uncertainty. For context, the loan book has grown consistently from £2.2 billion in 2008 to its current level, demonstrating CBG’s ability to expand prudently over multiple credit cycles.

4. Portfolio Simplification

Over the past 18 months, CBG has taken decisive steps to simplify its business and focus on core lending operations. The company has sold Close Brothers Asset Management, its Winterflood Securities brokerage, and its Brewery Rentals division. It is refocusing its Premium Finance business toward commercial rather than personal lines, planning an exit from its Vehicle Hire segment, and has settled long-standing litigation related to Novitas, paving the way to wind down that business.

5. Cost Reductions

CBG has launched an aggressive cost-reduction program. In fiscal 2025 it achieved £25 million in savings and has identified an additional £20 million in annual savings for each of the next three years. These efficiencies stem from consolidation, centralization, and investments in technology and artificial intelligence.

Overall, there are no clear signs of acute operational weakness. The company’s core lending franchises remain intact, its capital position is strong, and its profitability prospects are improving as restructuring efforts take hold. Once the redress process is finalized, CBG appears well positioned to return to its historical levels of earnings and valuation.

Management

Overall, Close Brothers’ management has performed well, setting aside this legacy legal issue.

First, the company has been consistently well run since at least the global financial crisis. Its strategy has been clear and disciplined: identify narrow niches within the banking sector, build expertise in each, and make prudent, well-collateralized loans. While the bank arguably spread itself across too many segments in prior years, that issue is now being addressed through a series of divestitures and refocusing efforts.

Second, management has responded prudently to the FCA investigation. They suspended the dividend to preserve capital and sold non-core operations to strengthen liquidity and bolster the Tier 1 capital ratio. These steps have simplified the company and concentrated resources around its most profitable and defensible lending activities.

Third, under the new CEO, Close Brothers has launched a credible cost-reduction program. Management expects £25 million of savings in fiscal 2025 and an additional £20 million per year for the next three years. The annual report outlines concrete steps that lend credibility to these targets.

Finally, the company has a long history of shareholder discipline. Although it has not repurchased shares, it has avoided issuing new equity, keeping the share count remarkably stable at roughly 150 million since 2014. Historically, CBG has also returned substantial capital to shareholders through dividends, reflecting a conservative but shareholder-friendly approach.

Valuation

Revisiting the calculations from the The Simple Value Story section and updating for the anticipated additional redress provisions yields a compelling picture.

If the full £135 million additional provision is taken, tangible equity would stand at £1.43 billion. With 150 million shares outstanding, that equates to a tangible book value per share of about £9.56. A re-rating to tangible book value (a 1.0 book-to-market ratio) implies 123% upside from the current price.

Alternatively, valuing the stock based on its historical relationship to adjusted operating income gives a similar conclusion. In fiscal 2025, adjusted operating income was £144 million. Historically, CBG’s market capitalization has averaged 8.5 times adjusted operating income. Applying that multiple yields an implied market value of £1.38 billion, or roughly 111% upside from today’s level.

Both estimates appear conservative. Historically, CBG’s shares have traded at a premium to tangible book value (around a 0.75 book-to-market ratio), and current earnings are temporarily depressed by litigation-related costs. As the redress process concludes and the company reverts to normal operations, it seems reasonable to expect adjusted operating income to recover toward £200 million annually.

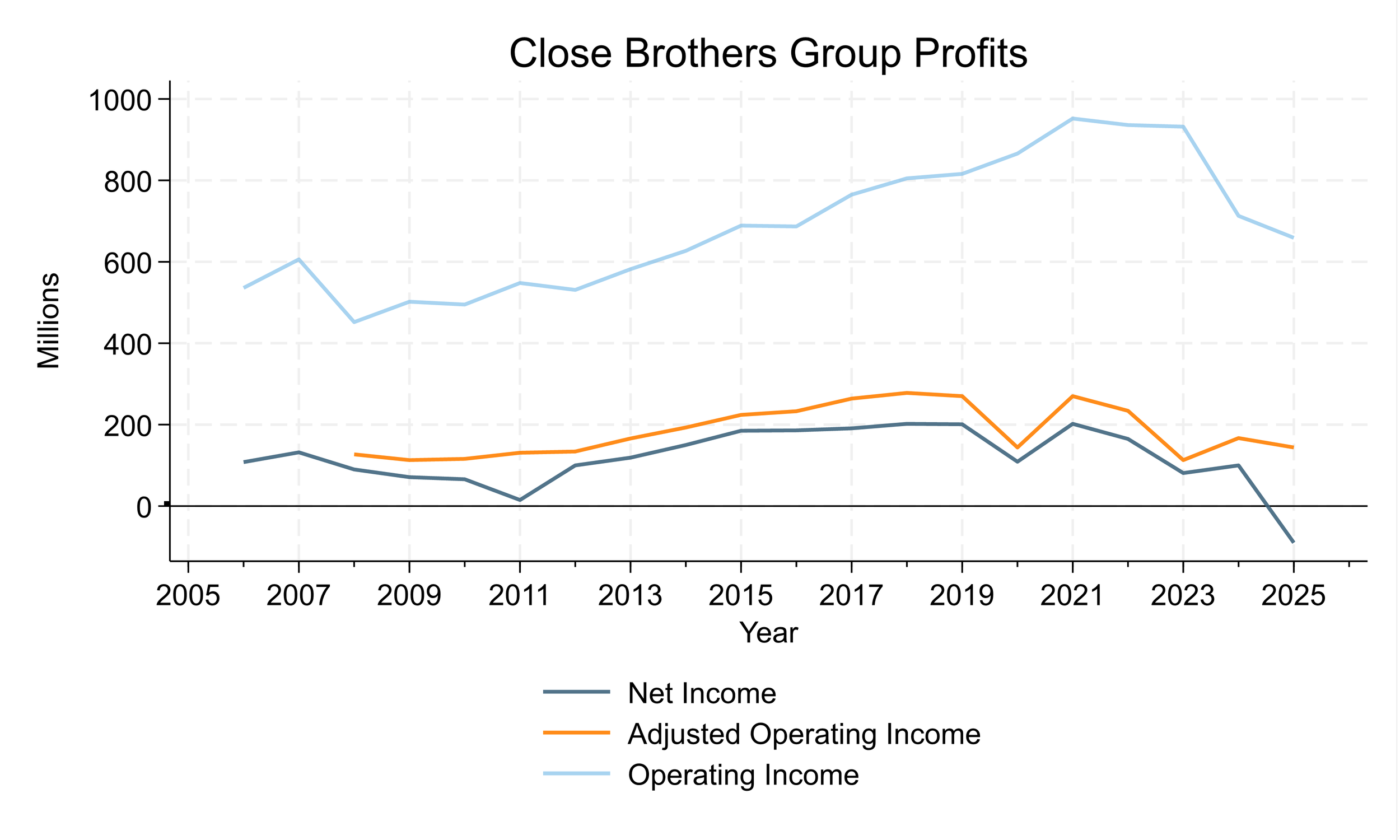

The chart below shows CBG’s historical net income, operating income, and adjusted operating income, illustrating how current profitability sits well below normalized levels.

NOTE: To reiterate, the negative net income in 2025 is due to the £165m provisions and elevated legal fees related to the legal battles.

Conclusion

Across all valuation measures—tangible book value, earnings multiples, and peer comparison—Close Brothers Group appears significantly undervalued. Even under the seemingly worst-case scenario of a £300 million redress cost, the stock remains cheap relative to both its history and typical value metrics.

In the meantime, operations remain stable, the balance sheet is strong, and the business model is being simplified and streamlined under capable leadership. With ongoing cost reductions and a credible plan for normalization, there is a strong case that the stock could double over the next few years as the legal overhang dissipates and the company returns to steady state earnings.

The key risks are a materially higher-than-expected redress cost, a broad UK recession, or unexpected credit losses within the £9.5 billion loan book. None of these risks appear imminent, but they are possible.