CAIRO MEZZ PLC

Price per share when purchased: €0.41 Date of posting: Oct 5, 2025 Price at posting: €0.50

The Business

Cairo Mezz (Ticker: CAIROMEZ or 6H3.F) represents the mezzanine tranches of securitized non-performing loans (NPLs) backed by Greek real estate. These securities were issued under Eurobank’s “Cairo” securitization program, which transferred distressed loans off the bank’s balance sheet. The mezzanine notes are subordinated to senior tranches but retain residual claims on the underlying collateral. As recoveries on the real estate portfolio improve, the residual value of Cairo Mezz can increase disproportionately, potentially by several multiples.

The Simple Value Story

On conservative assumptions, the book value of Cairo Mezz securities is roughly €240 million, versus a market capitalization of €157 million, implying a book-to-market ratio of 1.53 and potential upside of about 53 percent. This estimate likely understates intrinsic value. Loan recoveries continue, collection processes have matured, and Greek property prices have risen steadily. As these factors compound, the realized value of the mezzanine tranche could exceed conservative estimates by a wide margin.

Discussion

Following the 2008 global financial crisis, Greece entered a prolonged recession driven by fiscal austerity, collapsing credit, and a steep decline in property values. Between 2008 and 2018, the Greek real estate index fell from 100 to 57, and roughly 40 percent of loans to small and medium-sized enterprises became non-performing.

These NPLs froze the banking sector and constrained new lending. In response, the Greek government introduced the Hercules Asset Protection Scheme (HAPS) in 2018, enabling banks to securitize NPL portfolios with government guarantees on senior tranches to restore investor confidence.

The initial Cairo securitization totaled €7.5 billion, divided as follows:

Senior tranche: €2.4 billion (government guaranteed)

Mezzanine tranche: €1.45 billion

Junior tranche: €3.6 billion

Cairo Mezz was created by carving out portions of the mezzanine and junior tranches from this broader securitization—specifically, 75 percent of the mezzanine (€1.09 billion) and 45 percent of the junior (€1.62 billion) tranches, for a combined €2.7 billion face value, approximately 39 percent mezzanine and 61 percent junior exposure.

Cash flows follow a traditional waterfall structure: loan recoveries first service senior interest and principal until fully repaid, then the mezzanine tranche, and finally the junior tranche. The subordinated tranches accrue interest until higher-priority tranches are satisfied.

When trading began in September 2020, Cairo Mezz had 309 million shares outstanding at €0.10 per share (market value €30.9 million). Independent auditors valued the expected cash flows at €57 million on a 20-year horizon using a 17 percent discount rate, reflecting deep uncertainty about Greece’s recovery prospects at that time.

Since then, Greek property prices have surged, with the national real estate index rising from 68.7 in Q3 2020 to 110.9 in Q2 2025—a 61 percent increase. The improvement in collateral quality implies that the fair value of the mezzanine and junior tranches has risen substantially, even though the market continues to price them at distressed levels.

The following diagram presents the time series for the index value of Greek properties that are 5 years or older (2009=100).

The substantial improvement in collateral quality suggests that the fair value of both mezzanine and junior tranches have risen materially, even though market pricing remains near distressed levels.

Estimation of Cairo Mezz Value

Valuing Cairo Mezz precisely is difficult given the opacity of the underlying portfolio and its extended recovery schedule. Nonetheless, several independent benchmarks allow a triangulation of intrinsic value, all suggesting that the current market price materially understates fair value.

Initial Sale Pricing Implies Minimal Value for Subordinated Tranches

When the original €7.5 billion Cairo securitization was executed, the €2.4 billion senior tranche (32 percent of face value) was government-guaranteed. The entire issue sold for €2.59 billion (34.5 percent of face value), implying that only €190 million (2.5 percent) of value was attributed to the combined €5.05 billion of mezzanine and junior tranches. Since that sale, Greek real estate values have risen over 60 percent, suggesting a material revaluation of these subordinated claims.

Auditor Valuations Have Risen with Real Estate Recovery

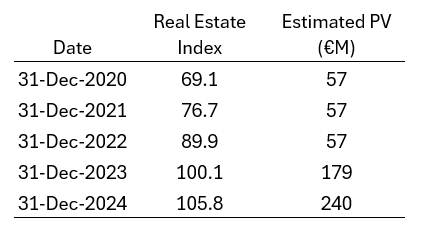

Auditors’ annual valuations of Cairo Mezz cash flows, discounted at 17 percent, show a sharp rebound in estimated present value as property markets recovered. The following table presents the real estate index and the estimated present value of the Cairo Mezz securitization over the last five years. Since 2022, the real estate index and estimated value have increased steadily.

With 309 million shares outstanding, the 2024 valuation of €240 million implies €0.77 per share, roughly 55 percent above the current €0.50 trading price.

Linear Extrapolation Indicates Further Upside

A simple linear regression of estimated value on the real estate index indicates each one-point rise in the index adds roughly €11 million in estimated present value (R² = 0.99). With the index now near 110, the implied valuation is €290 million (€0.94 per share), an 87 percent premium to the market price.

Lower Discount Rate Doubles the Estimate

The auditor’s 17 percent discount rate, appropriate in 2020’s high-risk environment, likely overstates required returns today. Using a 10 percent discount rate raises the present value to roughly €493 million (€1.60 per share), representing 219 percent upside[1].

Recovery-Based Valuation Suggests Order-of-Magnitude Upside

Greek banking sources estimate that about 50 percent of Cairo Mezz loans will ultimately repay at 65 percent of face value. Applying these parameters (0.50 × 0.65 × €2.7 billion) yields an implied value of €900 million (€5.73 per share), more than ten times the current market capitalization.

Potential Catalyst

As Greece’s economy normalizes, many non-performing loans are transitioning to re-performing status. Regulations require three years of sustained payments before reclassification, meaning loans restructured during 2023–2024 will qualify in 2026–2027. Greek banks have shown strong interest in repurchasing these re-performing loans, a development that could refocus investor attention and materially reprice Cairo Mezz securities.

Conclusion

Reliable information about Cairo Mezz’s holdings remains opaque. At inception, the vehicle held roughly €2.7 billion in subordinated mezzanine and junior debt carved out of the €7.5 billion Cairo securitization. These claims will not receive repayment until the €2.4 billion of Cairo securitization senior notes and accrued interest are fully satisfied.

Over the past five years, however, Greece’s economy and real estate markets have strengthened markedly. If current property values hold, or continue to rise, and borrowers maintain repayment momentum, the residual value of Cairo Mezz could appreciate substantially.

The principal risk remains macroeconomic: a downturn in Greece’s economy or property market could quickly erode this potential. The investment’s ultimate outcome therefore depends on the durability of Greece’s recovery, an inherently difficult variable to forecast.

Summary Assessment

Current Price: €0.50

Estimated Fair Value (Base Case): €0.77–€0.94

Optimistic Scenario: €1.60–€5.70

Primary Risks: Macroeconomic downturn, real estate correction, delayed recoveries

Potential Catalysts: Reclassification of re-performing loans (2026–2027); improving collateral recoveries

[1] This calculation was done using the formula for the present value of a perpetuity (P=f/i). I solved for f using from P=€240m and i=0.17, so f=290*0.17=49.3. Then I recalculated P using i=0.1, so P=49.3/0.1=€493m. This is obviously not exactly right, but approximating a 20-year cash flow with a perpetuity is close enough for this purpose. The critical element is more likely to be errors in the timing of cash flows. If the actual cash flows are in the near future then the estimate overstates the present value, but if the cash flows are in the distant future then the estimate understates the present value. With the waterfall structure of cash flows the actual cash flows are likely to be further in the future.