AerCap Holdings

Price per share when purchased: $143.66 Date of posting: Feb 1, 2026

Business

AerCap Holdings (AER) is the world’s largest aircraft leasing company. It manages a fleet of approximately 1,500 aircraft, 1,200 engines, and 300 helicopters. It is headquartered in Dublin, Ireland.

At the time of writing, AerCap has a market capitalization of approximately $25 billion and reported book equity of $18.1 billion. Over the last twelve months, the company generated $8.3 billion in revenue and $3.8 billion in net income, implying a price-to-earnings ratio of roughly 7.

The Simple Value Story

Historically, AerCap’s market value has traded within a relatively narrow range around book value. Since COVID, however, a significant imbalance has emerged between airline demand and aircraft supply, driving aircraft prices and lease rates materially higher. This environment benefits AerCap in three important ways.

First, as a large buyer of aircraft, AerCap places orders years in advance and locks in prices well below current market levels. Second, higher aircraft prices allow AerCap to reset lease rates upward as existing leases roll off. Aircraft leases are typically written for approximately seven years, and many of the company’s lower-priced COVID-era leases are now expiring. Third, AerCap typically sells aircraft after roughly 15 years of service. The company sells approximately 100 aircraft per year, and the resulting gains on sale flow directly into net income and book value.

Based on current lease rates, replacement costs, and resale values, I estimate that AerCap’s fleet of approximately 1,500 aircraft is worth about 30% more than its carrying value on the balance sheet. Flight equipment held for operating leases is recorded at roughly $58 billion. A 30% uplift implies a market value closer to $75 billion, or approximately $17 billion above book value.

Adjusting for this understatement implies true equity value of roughly $35 billion, compared with a current market capitalization of $25 billion — an implied discount of about 40%. At the current share price of $143, this suggests a fair value closer to $200 per share.

Valuation with Equity

AerCap owns approximately 1,500 aircraft, representing roughly 100 aircraft from each vintage year over the past 15 years. It acquires about 100 new aircraft annually, leases them for approximately 15 years, and then sells a similar number each year.

Because AerCap orders aircraft years in advance and has substantial negotiating leverage, it is able to lock in prices well below prevailing market levels. As aircraft prices have risen due to supply constraints, this purchasing advantage has become increasingly valuable.

At present, AerCap reports total assets of $71 billion, of which $58 billion is flight equipment. Increasing the value of flight equipment by 30% raises total assets to approximately $89 billion. With total liabilities of roughly $54 billion, this implies total equity of $35 billion [1].

With approximately 170 million shares outstanding [2], adjusted equity value is approximately $205 per share.

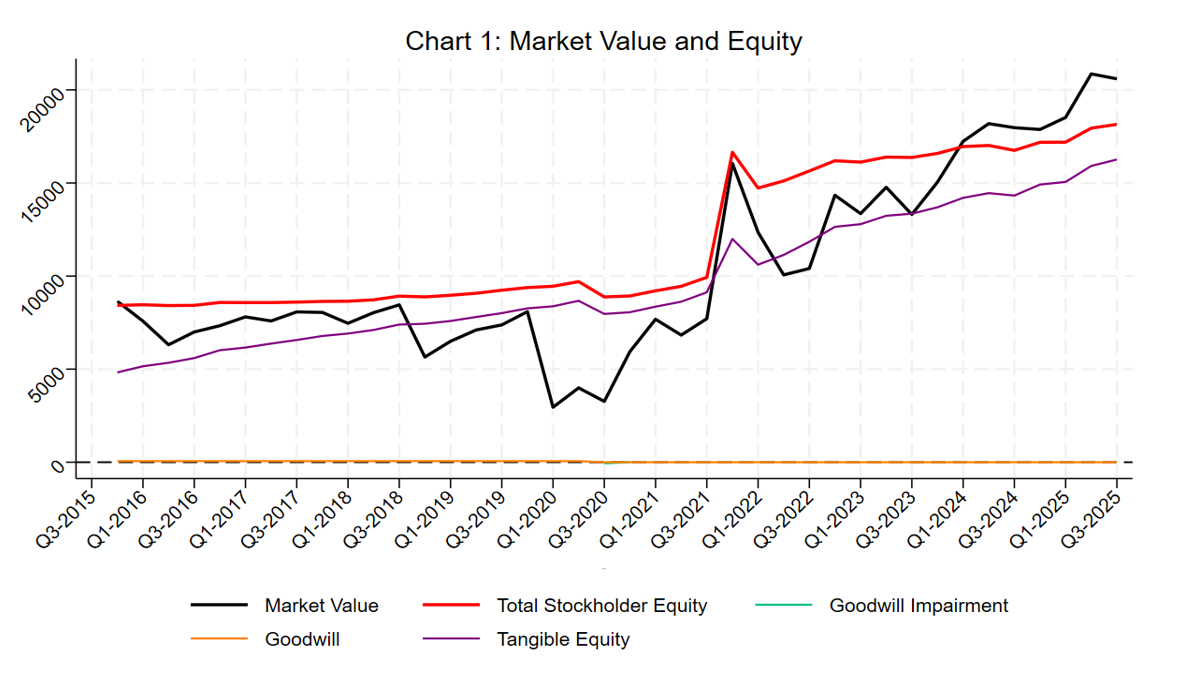

The following chart plots AER’s market value (in black) and total equity (in red). Historically, AerCap’s market capitalization has tended to track book value closely, suggesting that over time the share price should converge toward the book value per share of $205.

Valuation with Estimated Future Earnings

Lease rates declined sharply during COVID and have since recovered. However, because leases are long dated, the full earnings impact of higher lease rates is realized gradually as contracts expire and are renewed.

I estimate after-tax operating income, including gains on aircraft sales, of approximately:

$2.7 billion in 2026

$2.85 billion in 2027

$3.0 billion in steady state thereafter

Discounting these cash flows at 9% yields a present value of approximately $33 billion, which is broadly consistent with the adjusted equity valuation above.

Share Repurchases

AerCap has aggressively repurchased shares over the past decade, particularly when the stock has traded well below intrinsic value.

During the first three quarters of 2025, AerCap repurchased 18.6 million shares for approximately $2 billion, and in Q3 approved an additional $750 million authorization.

If AerCap repurchases an additional $2 billion of stock over the next year at $143 per share, it would retire approximately 14 million shares, reducing shares outstanding to roughly 156 million. Assuming $2.7 billion of earnings in 2026, total equity would rise to approximately $35.7 billion, implying equity value of roughly $228 per share.

Even without further repurchases, total equity would rise to approximately $37.7 billion, implying equity value of $221 per share on 170 million shares outstanding — roughly 55% above the current price.

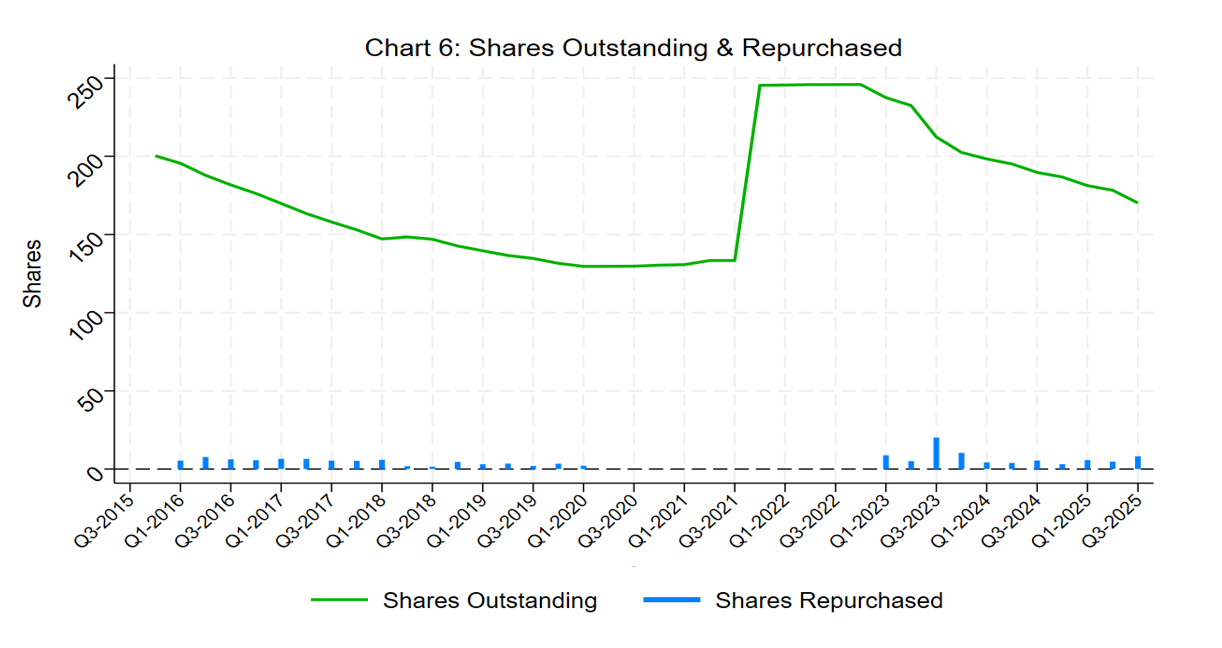

The following chart presents past shares outstanding and repurchases. This spike in shares outstanding in 2021 was the result of the GECAS merger in 2021 (see the next section).

GECAS Purchase

In 2021, AerCap acquired GE’s aircraft leasing business (GECAS) at a time when COVID was severely depressing lease rates and GE was under financial pressure. It is widely believed that AerCap acquired these assets at an attractive price. Part of the way it financed the deal was to issue 111.5 million shares [3].

To the extent that AerCap underpaid for the GECAS portfolio, the transaction represents an additional source of unrecognized value in reported book equity.

Spirit Bankruptcy

In 2025, Spirit Airlines entered bankruptcy and canceled its commitment to purchase 52 Airbus A320-family aircraft. AerCap ultimately obtained the rights to these aircraft, along with options on an additional 45 aircraft.

Management has stated that AerCap is acquiring these aircraft at prices below current market levels. While the specific pricing has not been disclosed, any discount relative to market value further increases AerCap’s underlying equity value.

Management

AerCap’s management team has executed extremely well.

The company has consistently:

Acquired aircraft portfolios at attractive prices (GECAS, Spirit)

Deployed capital aggressively when competitors were distressed

Repurchased shares when trading materially below intrinsic value

Passed on the opportunity to bid on Air Lease Corporation (AL) because the price was too high.

These actions have compounded intrinsic value per share over time.

Notes

Recent earnings include insurance recoveries related to aircraft previously leased in Russia. AerCap has received $2.9 billion of $3.5 billion in claims to date. I exclude any additional recoveries from forward earnings estimates.

The company benefits from Ireland’s relatively low corporate tax rate of approximately 15%.

AerCap’s average interest cost is currently around 4%. While refinancing may occur at higher rates, this should be partially offset by higher lease rates in an inflationary environment.

AerCap’s Piotroski score is 8 [4].

Conclusion

Based on the analysis above, I estimate that AerCap shares are currently undervalued by approximately 40%.

AerCap appears exceptionally well run.

Management is aggressively repurchasing shares, which should help close this valuation gap over time. Because aircraft leasing is ultimately a commodity business, long-term stock appreciation is likely to be driven primarily by growth in equity value rather than multiple expansion.

The principal risk is a significant disruption to global air travel, most likely arising from a major recession. A recession is not unlikely. However, such an outcome would likely depress the share price, accelerate the pace of repurchases, and ultimately result in higher intrinsic value per share. The realization of that value would likely take several years.

[1] - This is basically a LIFO adjustment to the value of inventory.

[2] - I include the 4m shares of stock options that are not yet in the money in this total because if my analysis is correct the stock price will move higher and these options will be exercised.

[3] - These shares were issued to GE. GE monetized the transaction through secondary transactions and distribution to its shareholders. This may explain the large drop in AER’s share price in the aftermath of this purchase.

[4] - Piotroski analyzes a universe of stocks with relatively high book-to-market values. He further refines his analysis by identifying 9 metrics that he believes represent a firm moving in the right direction. Firms that have 8 or 9 of this metrics moving in a positive direction had elevated future stock prices relative to firms with lower scores.